PHEVs are no longer a no-brainer vs. hybrids

Plug-in hybrids are a great way to adapt to the electric-car future without having to rely on it, cold turkey. Those considering plug-in hybrid models this year have a number of better product choices than in previous years—with longer electric range, better drivability and additional off-road capability.

Yet suddenly, far fewer of them are making as much financial sense versus hybrids, due to the abrupt loss of the federal EV tax credit for many of the market’s PHEVs after President Biden signed the Inflation Reduction Act (IRA).

2021 Jeep Wrangler 4xe

The revamped credit under IRA, called the Clean Vehicle Credit, only applies to plug-in hybrids and EVs that are American-made. And with the exception of a handful of PHEVs from Chrysler, Ford, Jeep, and Lincoln, plus a few more select models from Audi, BMW, and Volvo, EV tax credit eligibility has been drastically cut.

Do your calculations on cost, fuel, electricity

Until recently, plug-in hybrids have been a smart choice if you value low operating costs and the best overall value—while maximizing battery resources and making, in most cases, a greener choice versus hybrids.

Loren McDonald, founder and chief analyst of the consultancy EVAdoption, cites the Kia Niro Plug-In Hybrid as an example. It previously qualified for a $4,585 tax credit, nearly negating the $4,900 price difference with the Niro Hybrid. But now? Well, it depends on whether or not you still might be eligible for state or even local incentives applying to plug-in hybrids.

“Opting for the PHEV version may have been a no-brainer for many buyers,” McDonald notes, when adding in state and utility incentives, plus lower fuel costs, but now it will require more consideration.

While it’s certainly too early to tell based on market data, there may be cases where prospective buyers turn around and get a hybrid instead.

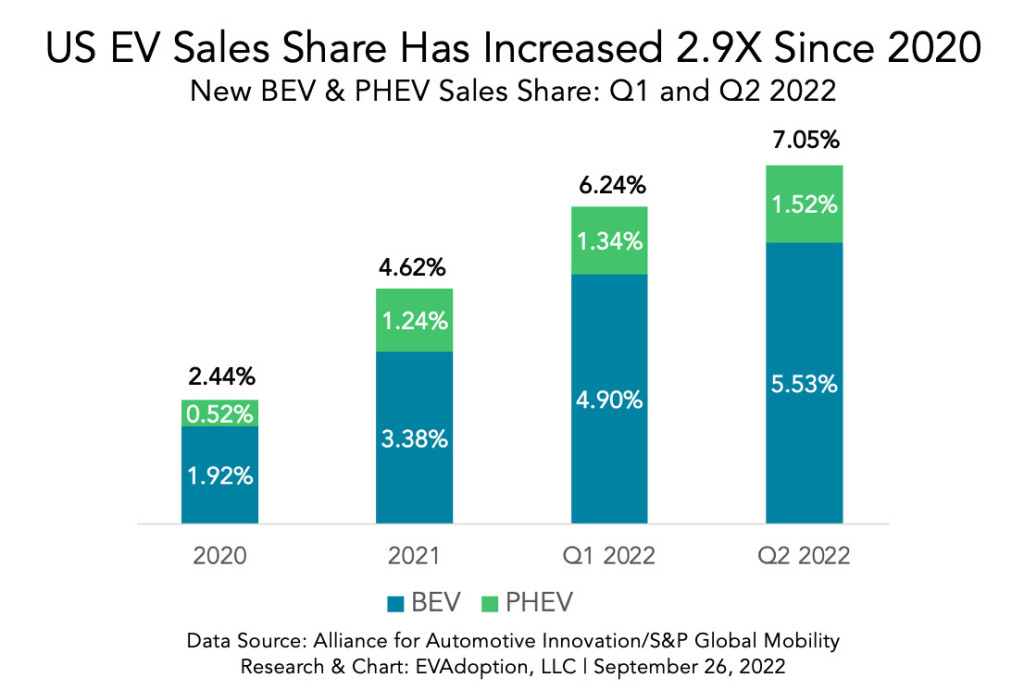

U.S. EV and PHEV sales share – EVAdoption

PHEVs have seen steady growth along with EVs over the past few years. And while EVs appear to be locked onto a rapid-rise trendline, there’s not as strong a long-term prognosis for PHEVs. As of July—before the passage of the IRA—S&P expected that in 2030 just 5% of U.S. new vehicle sales would be plug-in hybrids, versus 47% fully electric vehicles. That’s up from the 1.5% PHEVs and 5.5% EVs anticipated by EV Adoption for the second quarter of 2022.

No tax credit, yet PHEV sticker prices rising?

There have been a few plug-in hybrid market introductions in recent weeks, and the pricing decisions have been a bit surprising. Despite the loss of the tax credit, these prices on newly ineligible PHEVs have gone up versus eligible predecessors.

Mitsubishi confirmed one such example this past week. Its 2023 Outlander Plug-In Hybrid will start at $41,190, including the mandatory $1,345 destination fee. That’s up nearly $3,000 in sticker price, from $38,240 for 2022.

In bottom-line money for most purchasing households, the Outlander PHEV is up more than $9,500 versus last year. The Outlander PHEV used to be eligible for the federal EV tax credit—an amount of $6,587 based on its battery capacity. The 2023 version, with its larger 20-kwh battery pack, would have been eligible for the full $7,500 amount had it reached the market before the August 16 signing.

2023 Mitsubishi Outlander Plug-In Hybrid

As we reported in a first drive of the Outlander PHEV, this model’s bigger battery, stronger electric motors and expanded electric-only operation provide an excellent 38 all-electric miles of operation plus a seamless transition between power sources in hybrid mode. It represents the best technology from the Japanese brand and is a strong alternative to the Toyota RAV4 Prime, best that vehicle with an additional row of seats.

Kia also, since the tax credit demise, hiked the base price of its Sorento Plug-In Hybrid by more than $5,000 for 2023, versus 2022. That roomy, three-row model was also eligible for $6,587 under the outgoing EV tax credit, meaning that the 2023 Sorento PHEV, at $51,185, now costs about $11,600 more than last year’s model. That’s for a “streamlined” lineup putting all the focus on the top-of-the-line SX-P trim, including all-wheel drive, a suite of driver-assistance features, and an AC inverter good for powering a laptop.

Will more PHEVs be made in America?

While Stellantis’ Jeep Wrangler 4xe and Chrysler Pacifica Hybrid are two of the top-selling American-built plug-in hybrids for which the EV tax credit still apply, the buyers of the popular Toyota RAV4 Prime and Prius Prime can no longer claim it due to their Japanese assembly.

The loss of the EV tax credit for imported models also includes some of the PHEVs with the longest electric range, such as all but one of Volvo’s Recharge PHEVs recently given larger battery packs. While the XC60 Recharge PHEV we drove last year is among those counted out for their European assembly, Volvo’s South Carolina–built S60 T8 Recharge sedan, at 41 EPA-rated electric miles, is its sole PHEV that currently qualifies.

2022 Volvo XC60 Recharge

McDonald doesn’t see that the IRA will necessarily cause a shift of more plug-in hybrids from foreign-made to American-made. That’s because one of the key issues isn’t just the potential sales volume that might make U.S. assembly worthwhile, but whether or not they can meet future battery cell and mineral requirements as laid out for the Clean Vehicle Credit.

“Since they are both selling at a significant volume (from an EV perspective) and assembled overseas, they may not believe it is worth the investment to shift manufacturing to North American factories,” he says about the Toyotas.

California’s 50-mile requirement

Furthermore, the tighter regulations from California—adopted by at least nine other states—are another factor. They require that PHEVs deliver 50 miles of electric range, starting with the 2026 model year, to earn the full ZEV credit amounts from the state’s Air Resources Board.

2023 Hyundai Tucson Plug-In Hybrid

That requirement could be a last straw for automakers, in terms of the number of PHEVs they can produce with bigger batteries and added complexity while also adding more fully electric models, and it might potentially swing automakers that are currently very bullish on PHEVs, like Hyundai and Kia, away from them. They might instead focus on a few U.S.-sourced, U.S.-assembled EVs that would qualify and be more cost-effective.

“Some automakers may simply use this requirement as a catalyst to exit the PHEV business and focus on regular hybrids and full BEVs,” said McDonald.

Market forces could fix this

Michael Fiske, associate director for powertrain forecasting at S&P Global Mobility, suggested that the market forces around simple supply and demand might be limiting the growth of PHEVs as a greener possibility for some shoppers.

Demand far outpaces supply, and it will for the next year or so, said Fiske, inflating sticker prices and transaction prices. “These vehicles are positioned to be competitive in the current environment, and the current environment is anything but normal,” he said.

“The manufacturers, they have shareholders, and need to maximize their profits, and that’s an easy way to do it,” Fiske added. “There’s no need to try to discount it to try to attract more buyers because you’re going to be selling out no matter what.”

Fiske said there’s a sense within the industry that the market will normalize and prices may need to come back down, but as some manufacturers will qualify for the new credit and others won’t, pricing will be readjusted differently. As such, some automakers will decide that plug-in hybrid is a good transition technology and others won’t.

Model lineups will change

How the combination of the IRA and the California requirements will affect plans for PHEVs vs. EVs remains to be seen, and it’s going to be a new and different calculation for each company.

“Manufacturers trying to figure out how to qualify or if it’s worth it anymore—that’s definitely going on,” Fiske said. “But as well, we still have a continuing semiconductor shortage, and that is playing a significant role, along with this overall inflation.”

2023 Volkswagen ID.4

Some automakers, including General Motors and Volkswagen, have years ago decided that plug-in hybrids aren’t worth it for the U.S.

With an arguably far more complex supply chain than EVs, involving engines, transmissions, battery packs, clutches, and many more components, shifts in plug-in hybrid manufacturing seem less likely in the near future—pegging PHEVs as less of the fiscally sensible technology bridge for automakers they might have once seemed.

The analysts we polled collectively said that the ones to watch as this unfolds will be Toyota, Nissan, Hyundai, and Kia, all of which were at least mulling plug-in hybrids as a transitional tech toward more EVs. With product cycles of at least three years, it’s not going to be immediate.

Just a little patience?

In this current market of short supply and overheated demand, it could just take some patience. Prices settling under market forces and incentives from California states may help align PHEVs back to a spot in which their operating costs make more sense for more families.

“The IRA, when we look at it holistically and not because of the current challenges in the market, is going to be more impactful on the types of decisions we’re seeing consumers make probably closer to 2025-2026, when they can see that normalization of the market,” anticipated Fiske.

So don’t write off PHEVs as a good solution to help shift drivers away from gas stations—but for another year or two, the choice may not be nearly as clear-cut as it was.

Related posts

EV Guide: How to Care for Your Electric and Hybrid Car