Used PHEV prices rose ahead of $4,000 tax credit eligibility

In the months even before we knew some used plug-in hybrids would be eligible for a $4,000 used EV tax credit, market interest in plug-in hybrids was on the rise, according to a recent pricing analysis.

In a blog post last month, the retail conglomerate Carmax explained search volume for the term “plug-in hybrid” has increased significantly since the start of 2021, peaking in June 2022, when consumers searched the term four times as much as in January 2021.

That’s just before used EV values appear to have peaked, according to several firms that track used car prices.

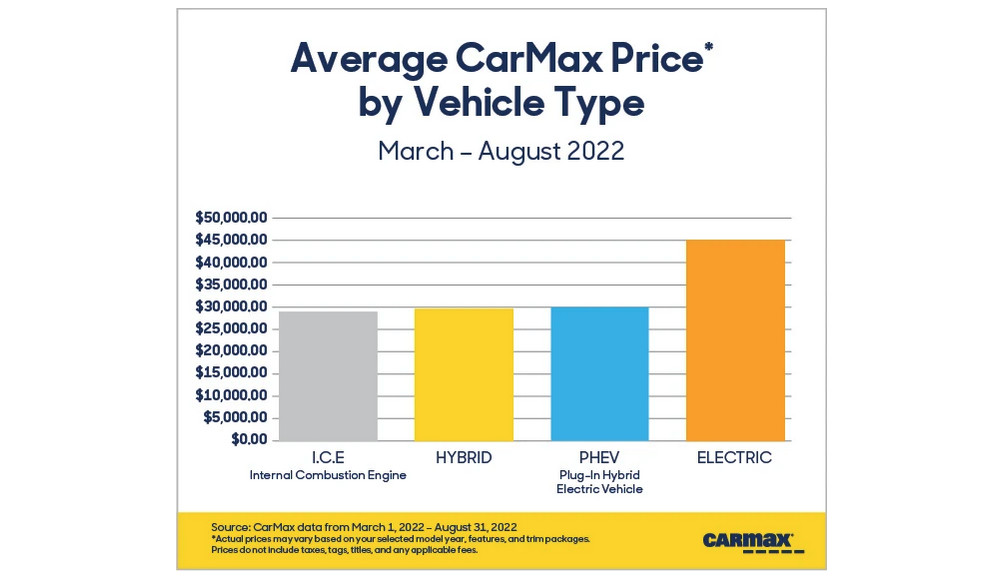

Average prices for used plug-in hybrids—along with conventional hybrids—have been lower than used EVs, but slightly above the average prices of used gasoline cars, according to Carmax.

Average Carmax price by vehicle type (March-August 2022)

The most popular used plug-in hybrid models in Carmax’s inventory are the Toyota Prius Prime and Chevrolet Volt. So this trend may give a new life on the used market—and perhaps appreciation of—the Volt. The plug-in hybrid hatch was once hailed as General Motors’ moonshot, but was soon overshadowed by all-electric models and ended up having a relatively short life.

In addition, the Toyota RAV4 Prime was the fastest selling vehicle overall at Carmax between March and August 2022. On average, the crossover sold in less than a week from when it was listed for sale.

The top states for plug-in hybrid sales, according to the used-car retailer, are all on the West Coast, with California, Oregon, and Washington ranked first, second, and third respectively, followed by New Mexico and Nevada. It’s worth noting that many plug-in hybrids were originally sold in the West Coast states, leaving a larger pool of used cars.

2022 Toyota Prius Prime

This report came as the federal government prepared to adopt a $4,000 tax credit for used plug-in hybrids under the Inflation Reduction Act (IRA)—a credit that, as of January 1 consumers can count on claiming for tax year 2023 if they meet specific requirements.

The rule as laid out by the IRA says that eligible vehicles must be at least two years old and they must have a battery with at least 7 kwh. They must cost less than $25,000, must be sold by a licensed dealer, and can’t be used twice to claim the credit. The credit also comes with income caps of $75,000 for single-filer income, $150,000 for joint filers, and $112,500 for head-of-household filers. The Internal Revenue Service (IRS) also recently specified that this credit will require a lot more reporting.

The IRS was seeking to fast-track the rules, and on the used-car side they don’t depend on details like mineral sourcing or whether they were made in America. On the other hand, the revamped EV tax credit of up to $7,500 for new cars depends on full guidance on American component and sourcing that has been delayed to March, with a leasing loophole that may apply to non-American-made EVs also yet to be clarified.

Add a comment Cancel reply

Comments (0)

Related posts

EV Guide: How to Care for Your Electric and Hybrid Car