EV market share fell in Q1, in a dearth of affordable models

U.S. EV and hybrid sales fell in the first quarter of the year, according to a Tuesday update from the Department of Energy’s Energy Information Administration (EIA).

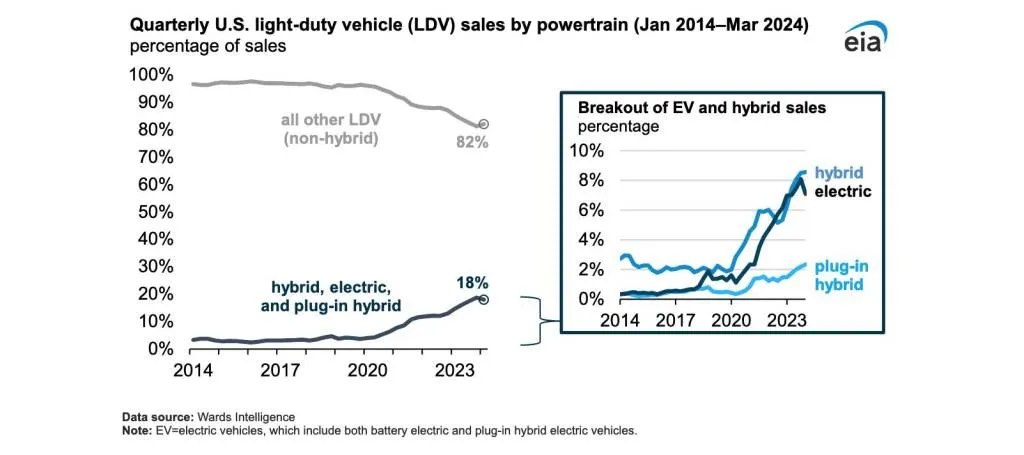

Sales of battery electric vehicles (full EVs) dropped to 7.0% of overall light vehicle sales in the first quarter of 2024 from 8.1% in the previous quarter. Nationally, sales of hybrids, plug-in hybrids, and EVs combined dropped to 18.0% of the market, versus 18.8% in the previous quarter.

As the EIA reports—in a trend that parallels a California EV trend for the quarter—EV sales by actual volume were actually up 7% in the first quarter of 2024 versus the same quarter in 2023. But to add another splash of context, that was after 13 consecutive quarters of double-digit percentage gains.

EIA update on EV and hybrid sales – May 2024

Multiple factors may be at play. Mass-market EV sales were way down, by 17.9%, and that appears to be related more to what’s available in the market than to demand. For instance, the Chevrolet Bolt EV was out of production in Q1 and disappearing from dealer lots, while GM’s next-most-affordable Chevy Equinox EV hasn’t yet arrived; and Nissan has slimmed down the Nissan Leaf lineup to just two trims.

2023 Nissan Leaf

On a transaction basis, the EIA pointed to Cox Automotive data suggesting that EV transaction prices remain about $6,900 higher than the average vehicle price across the entire market. The number of vehicles eligible for the $7,500 EV tax credit that can make up for some or all of that difference is more limited than it was last year.

Meanwhile, there was a decline in the whole light-duty vehicle market, led by a sag in luxury-vehicle sales, at a time when eight out of 10 EV sales are luxury models. Luxury sales reached 18% of the new-vehicle market in 2023, but in Q1 they dropped to 16%. It’s a trend that’s difficult to extricate from the perfect storm of high interest rates and high sticker prices, after several years of nearly across-the-board price hikes. The agency notes that overall mass-market vehicle sales remain at about 10% below pre-pandemic levels, while the luxury sector bounced back two years ago.

2024 Tesla Model Y. – Courtesy of Tesla, Inc.

Modest Tesla sales gains in the U.S. year-over-year for Q1—of about 4% according to Automotive News, based on registrations—weren’t enough to offset either of these factors. It should be noted that the EIA based these data trends on Ward’s Intelligence data, which also draws from registration data.

In the U.S., the vast majority of EVs have effectively been priced and positioned as premium offerings if not luxury vehicles. This isn’t the case in the rest of the world, and if automakers want to get serious about EV sales in the U.S.—and make EV sales gains—low-priced EVs are the way to go.

Add a comment Cancel reply

Comments (0)

Related posts

Electric SUVs: Top 6 Models for Family Trips