Why do EVs cost more to insure than hybrids in 2024?

As more data rolls in from the insurance industry, an unfortunate trend has persisted for electric vehicles: They cost more to insure.

And there are enough of them in the vehicle fleet now to underscore that it’s no longer a matter of insurance companies covering themselves for the unknowns of a new vehicle type.

Based on calendar-year results examined by the insurance analytics team at LexisNexis Risk Solutions, EVs now have a 17% higher claim frequency and 34% higher claim severity versus what the firm considers “traditional segments.”

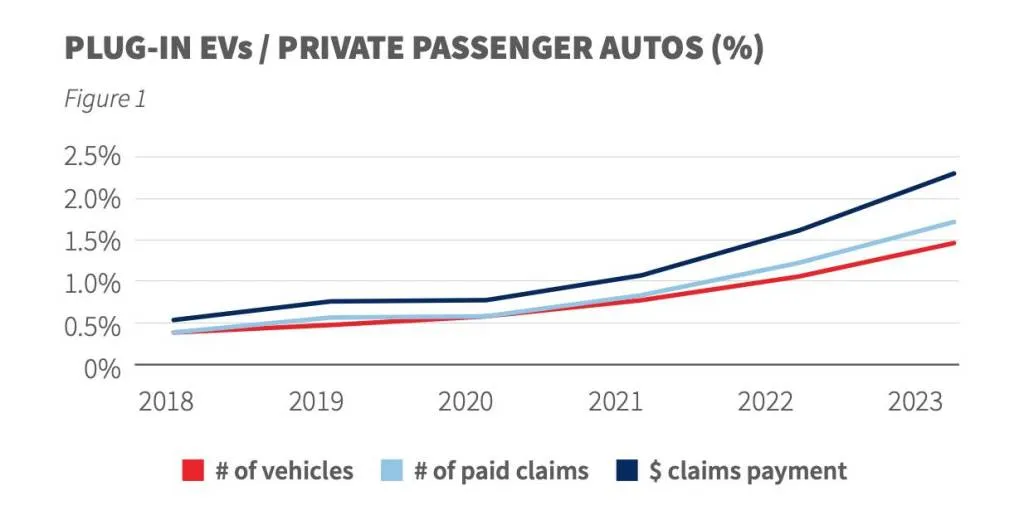

“Consequently, the number of paid claims, as well as the total claims payment amount for EVs has risen faster than the number of EVs as a percentage of the total PPA market over the year,” underscored LexisNexis in its report, out Thursday.

While the EV fleet in 2023 was 1.5% of the insured vehicle fleet, it represented 1.7% of all paid claims and 2.3% of the total claims payment, it says, citing its own proprietary analysis.

2022 Rivian R1T IIHS crash testing

As Consumer Reports found last year, EV insurance costs hundreds of dollars more annually versus comparable gasoline models, hybrids included. Based on the general factors presented by LexisNexis, plus the high cost of battery replacement, that’s not looking likely to change anytime soon.

EVs aren’t all bad news to risk-minded insurers. According to the Highway Loss Data Institute (HLDI), EVs are stolen less than gasoline cars.

More EVs didn’t cool the risk pool

As the report points out, 2023 was truly a big year for EVs out in the real world. EV sales increased 54% versus 2022, to 1.4 million in the U.S. That meant the total number of EVs insured grew by 40%, to 3.9 million vehicles, including plug-in hybrids, while insured private passenger vehicles grew just 1.2% to 265 million.

That bigger pool of owners and drivers—and vehicles—wasn’t enough to swing the odds more in EV drivers’ favor, however.

LexisNexis EV insurance claims trends – 2024 report

“Higher frequency and severity of EV claims have contributed to an escalating profitability challenge for all EV insurers,” the firm said, later stating: “Differing driving experiences in electric vehicles (EVs) have contributed to higher and more severe claims than internal combustion engine (ICE) vehicles.”

Green Car Reports has reached out to LexisNexis to understand what these driving experiences are, and if it’s referring to urban environments, less cautious driving, or some other factor.

Riskier driving, and it goes beyond EVs

American motorists in 2023 were riskier nearly across the board. Speeding, driving under the influence (DUI), and distracted driving offenses all went up, emerging well above pre-pandemic levels. DUI offenses were up nearly 9% in the first six months of 2023 versus the first six months of 2019.

Overall, across all types of vehicles, body injury severity rose by 20% from 2020 to 2023, while the severity of material damages (in amount claimed) has risen 47%.

A greater percentage of EV drivers were actively shopping around for lower rates, the firm observed—above the record levels of policy shopping and switching in 2023. That was spurred by sharp rate hikes inflicted by insurers starting in Q2 2022 that persisted at least through 2023—leading to an unprecedented 14% hike in insurance premiums for 2023 as a whole, year over year.

The high price of EV insurance has led Tesla to create its own insurance product. Tesla Insurance remains available in 12 states, and in all but California it uses a real-time algorithm impacting rates and based on driving habits.

2023 Chevrolet Bolt EV

LexisNexis was involved in a scandal in which GM shared driver-specific data on Chevy Bolt EV driving habits with the firm through its OnStar Smart Driver program—with many drivers not at all aware that they’d been enrolled by the dealership.

Meanwhile, insurers aren’t doing well on promptness or satisfaction. Two of five, or 40% of respondents, said that it had taken a month or longer to get the full payment from the insurer, and 46% of those involved in such a claim were dissatisfied with the experience. So there’s lots of room for insurers’ improvement—and, perhaps, competition for those safe drivers.

Add a comment Cancel reply

Comments (0)

Related posts

Electric SUVs: Top 6 Models for Family Trips