The European Automotive Industry Faces Major Challenges: Losing Its Position in the Global Market?

The European automotive industry, long considered a cornerstone of the economy, is facing severe challenges, some of which it may have brought upon itself. With declining sales, increased competition from China, and strict EU regulations, European automakers, especially Volkswagen, are struggling to maintain their market positions.

Electric Mobility as the Achilles’ Heel of European Industry?

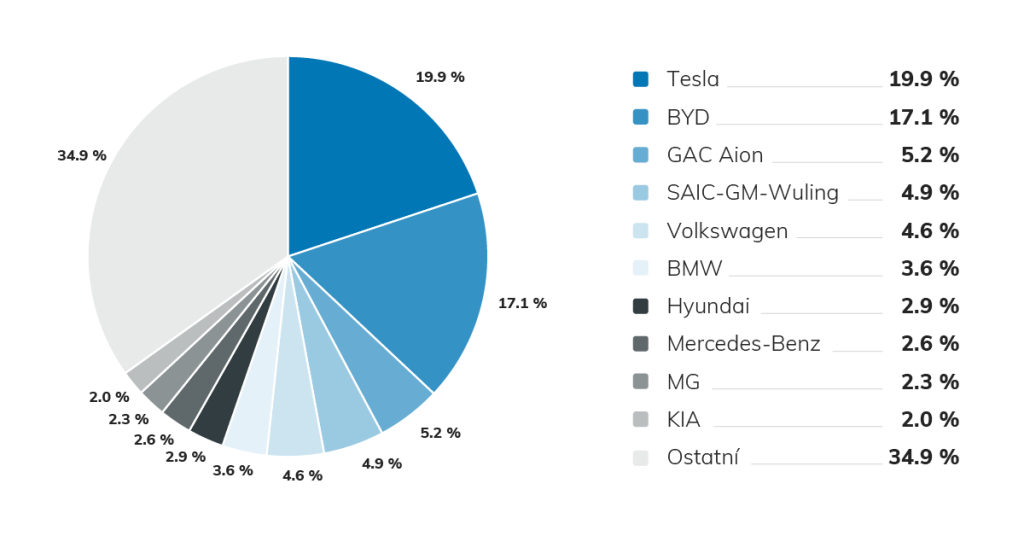

A significant challenge is the transition to electric mobility. European automakers rushed into China before 2000, leveraging lower production costs. However, the assumption that China would not overtake Europe technologically proved false. Chinese manufacturers like BYD and NIO now dominate the market, while Tesla leads globally. In 2023, Tesla held a 19.9% market share in electric vehicles, with BYD following at 17%. Volkswagen, once a dominant player, ranked fifth with only 4.6%.

In 2024, China will export more cars to Europe than Europe exports to China, marking a historic shift in the industry. The EU’s stringent emission regulations are adding further pressure. By 2025, all vehicles in the EU must reduce their carbon footprint from 116 grams of CO2 to 93.6 grams per kilometer. Failure to meet these standards will result in fines of 95 euros per excess gram of CO2. Volkswagen is in a particularly challenging position, needing to cut average emissions by 23% by 2025 to avoid substantial penalties.

The Impact of Chinese Competition

Chinese manufacturers have surged ahead, producing over a million electric vehicles in a single quarter of 2024, and now lead the global market alongside Tesla. Hybrid and electric vehicles already constitute 37% of all cars sold in Europe, with projections suggesting a 106% increase in the number of electric vehicles worldwide over the next five years.

Internal Struggles and Labor Issues at Volkswagen

Volkswagen’s internal challenges are equally significant. The company has announced cost-saving measures totaling 100 billion CZK, including the closure of two factories in Saxony, potentially resulting in the loss of 25,000 jobs. The situation is exacerbated by labor unrest, with union leaders in Wolfsburg vocally opposing these cuts. The cancellation of the “job security” program, which guaranteed no unilateral layoffs until 2029, has only intensified tensions.

Consequences of Dieselgate and Market Decline

The fallout from the Dieselgate scandal continues to haunt Volkswagen and the broader industry. The scandal severely damaged relationships with European regulators, leading to stricter emission limits and reduced influence over policymaking. Volkswagen has paid approximately 30 billion euros in fines due to Dieselgate, with ongoing legal battles and the possibility of further penalties.

Conclusion: Time for Radical Change

To navigate these challenges, the European automotive industry must invest heavily in innovation, develop the necessary infrastructure for electric vehicles, and shorten supply chains. There is also a need to shift focus from merely selling cars to enhancing overall mobility, in line with changing consumer preferences. According to experts like Ivan Hodač and Petr Knap, these measures are essential if European automakers hope to regain their footing and compete with their Chinese and American counterparts.

Related posts

Eco-Friendly Adventure: Sea Trip with an Electric Car